Oct

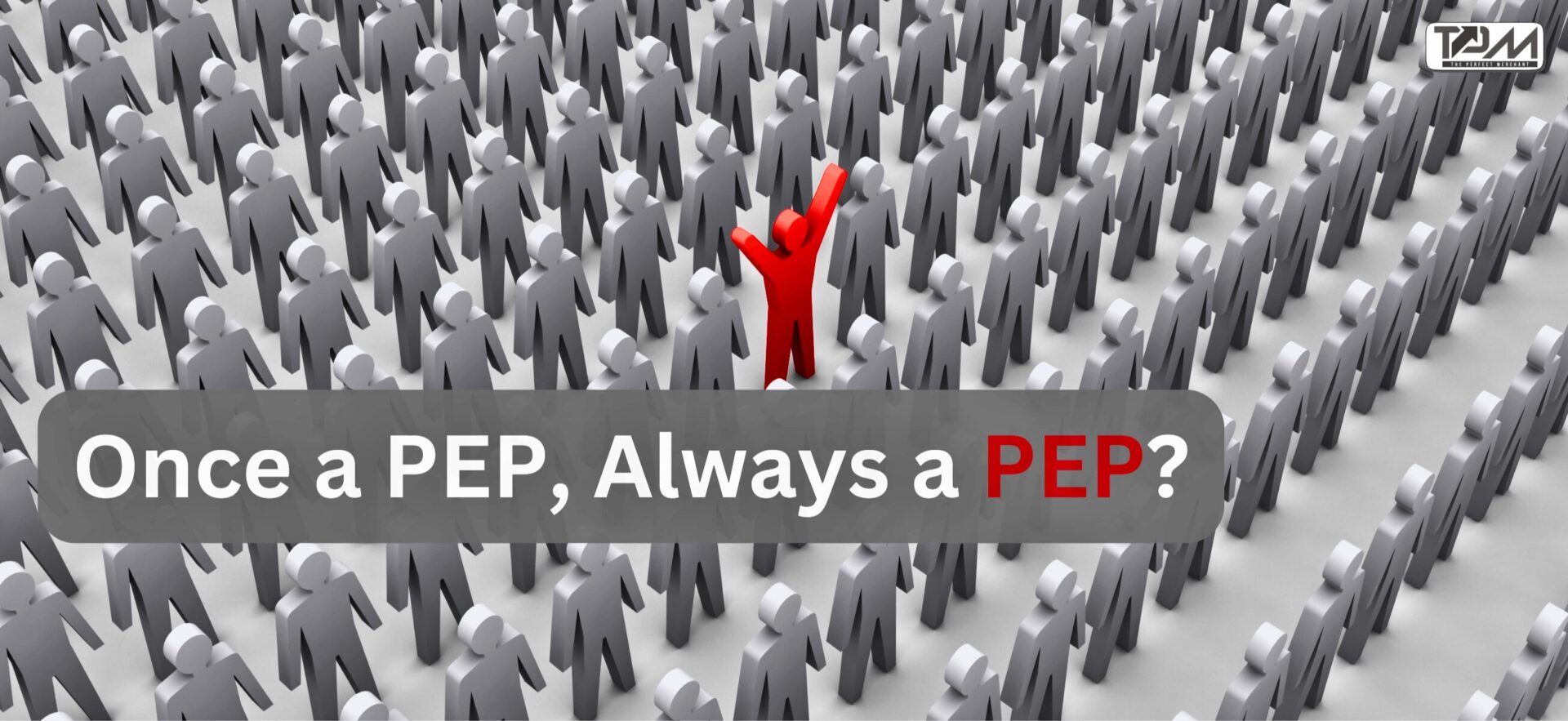

Once a PEP, Always a PEP: Why Financial Systems Keep Tabs on Former Officials

“Once a PEP, always a PEP” is a rule that drives how banks and other financial institutions handle accounts for politically exposed persons (PEPs). The term PEP refers to people with public influence—like politicians or top government officials—who could misuse…

Read More

Oct

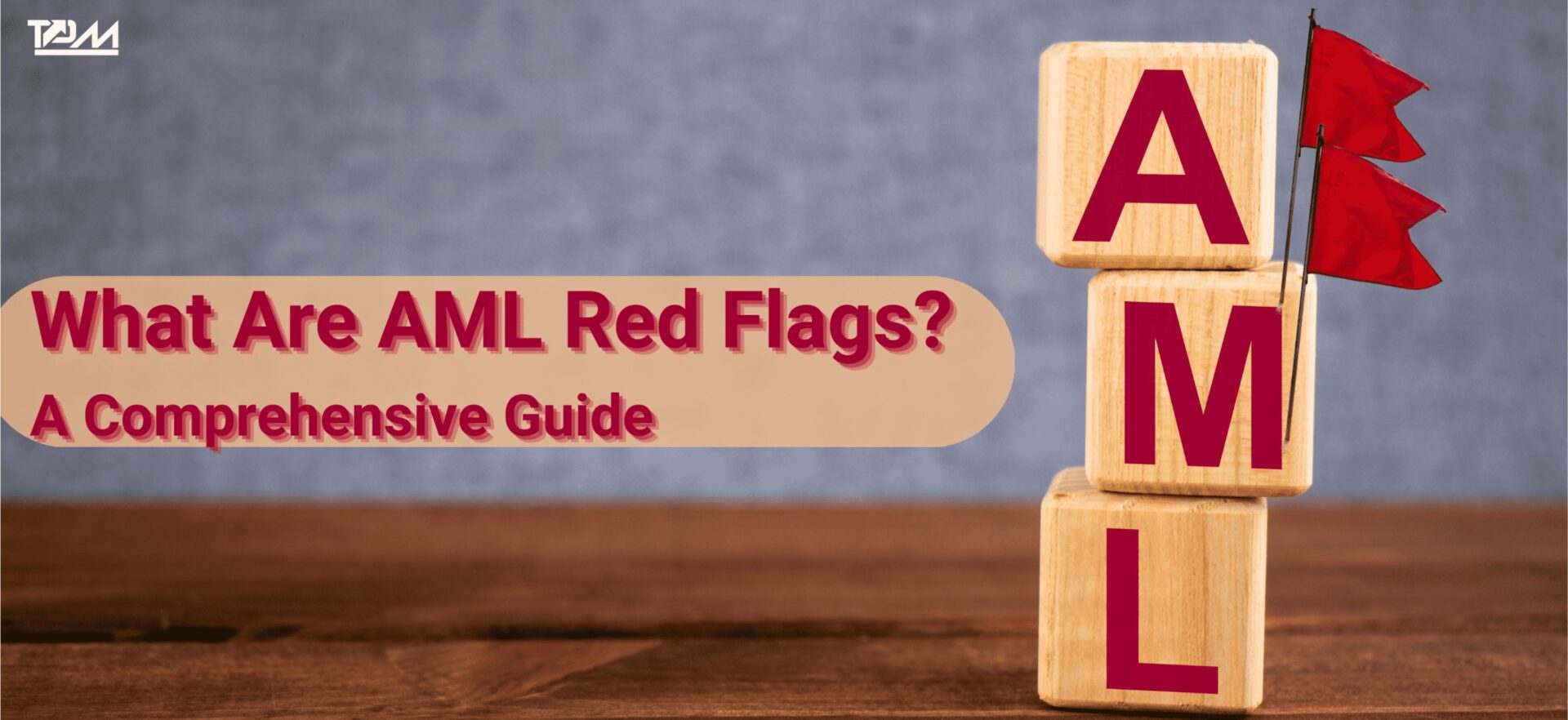

What Are AML Red Flags? — A Comprehensive Guide

Spot AML red flags early, or risk letting trouble sneak through unnoticed. When every transaction counts, missing a sign isn’t just a slip—it’s a potential compliance risk. What Is a Red Flag in AML? A red flag in anti-money laundering…

Read More

Oct

What Makes AML Database the Backbone of Anti-Money Laundering Infrastructure

Anti-money laundering compliance today means working with huge amounts of AML databases—from customer records and transactions to sanctions lists and watchlists. In this article, we’ll break down what an AML database is and its use cases to learn how AML…

Read More